Eight RBL Bank staff arrested in ₹2,000 crore cyber fraud case linked to Surat branches

Surat Police on Tuesday arrested eight employees of RBL Bank, including the area head and operations head, for allegedly aiding a large-scale cyber fraud network by opening and operating accounts used for illicit transactions. The accused were associated with the bank’s Vesu, Sahara Darwaja, and Varachha branches, where 89 accounts saw transactions worth ₹1,455 crore in just six months.The arrests are part of an ongoing investigation into a cybercrime operation believed to be worth over ₹2,000 crore.Initial breakthrough during routine vehicle checkThe case began unfolding after police intercepted a moped during a routine vehicle check in Udhna and found several PAN cards and proprietary firm stamps hidden in its storage compartment. The two-wheeler belonged to Ronak Sandip Sudani.Based on his statement to the police, authorities arrested Kirat Vinodbhai Jadvani and Meet Pravinbhai Khokhar—both residents of Surat. A search led to the seizure of mobile phones, debit cards, chequebooks, cash, computing equipment, and counterfeit materials, amounting to roughly ₹7.02 lakh.Accounts opened, SIMs handed over for fraudulent useDuring their interrogation, Jadvani and Khokhar admitted to running an operation out of Raj Textile Tower in Saroli. For the past nine months, they had been persuading individuals to open bank accounts in their names. The account kits, along with SIM cards registered to these accounts, were then handed over to another accused, Divyesh Jitendrabhai Chakrani, who forwarded them to a contact in Delhi, identified as Vineet Prasad.These materials were subsequently used by cyber fraud operators.Majority of suspicious transactions routed through RBL BankUdhna police’s Special Investigation Team (SIT) discovered 165 suspicious accounts across various banks, 89 of which were with RBL Bank. These 89 accounts alone processed transactions worth ₹1,455 crore over a six-month period.The scale and speed of these transactions raised suspicions of insider involvement, prompting the SIT to probe the role of bank personnel.Senior bank officials allegedly accepted bribesThe investigation revealed that several employees of RBL Bank, including senior staff such as the area head Amitkumar Gupta, operations head, and other staffers, had allegedly accepted bribes to open accounts in the names of unrelated individuals. These accounts were then used to conduct high-value transactions linked to cyber fraud.Police confirmed that the fraudulent activities were facilitated across the bank’s Vesu, Sahara Darwaja, and Varachha branches.Eight employees taken into custodyBased on evidence gathered during the investigation, the SIT arrested eight employees of RBL Bank on Tuesday. These include senior officials and front-line staff suspected of directly enabling the fraud through unauthorised account openings and negligent oversight.Case linked to larger cybercrime syndicateOfficials believe the racket may be part of a larger national or transnational cybercrime syndicate. Investigators are now working to trace the end-users of the fraudulent accounts and identify the final destinations of the laundered funds.The case remains under active investigation, and authorities have indicated that more arrests may follow.

Surat Police on Tuesday arrested eight employees of RBL Bank, including the area head and operations head, for allegedly aiding a large-scale cyber fraud network by opening and operating accounts used for illicit transactions. The accused were associated with the bank’s Vesu, Sahara Darwaja, and Varachha branches, where 89 accounts saw transactions worth ₹1,455 crore in just six months.

The arrests are part of an ongoing investigation into a cybercrime operation believed to be worth over ₹2,000 crore.

Initial breakthrough during routine vehicle check

The case began unfolding after police intercepted a moped during a routine vehicle check in Udhna and found several PAN cards and proprietary firm stamps hidden in its storage compartment. The two-wheeler belonged to Ronak Sandip Sudani.

Based on his statement to the police, authorities arrested Kirat Vinodbhai Jadvani and Meet Pravinbhai Khokhar—both residents of Surat. A search led to the seizure of mobile phones, debit cards, chequebooks, cash, computing equipment, and counterfeit materials, amounting to roughly ₹7.02 lakh.

Accounts opened, SIMs handed over for fraudulent use

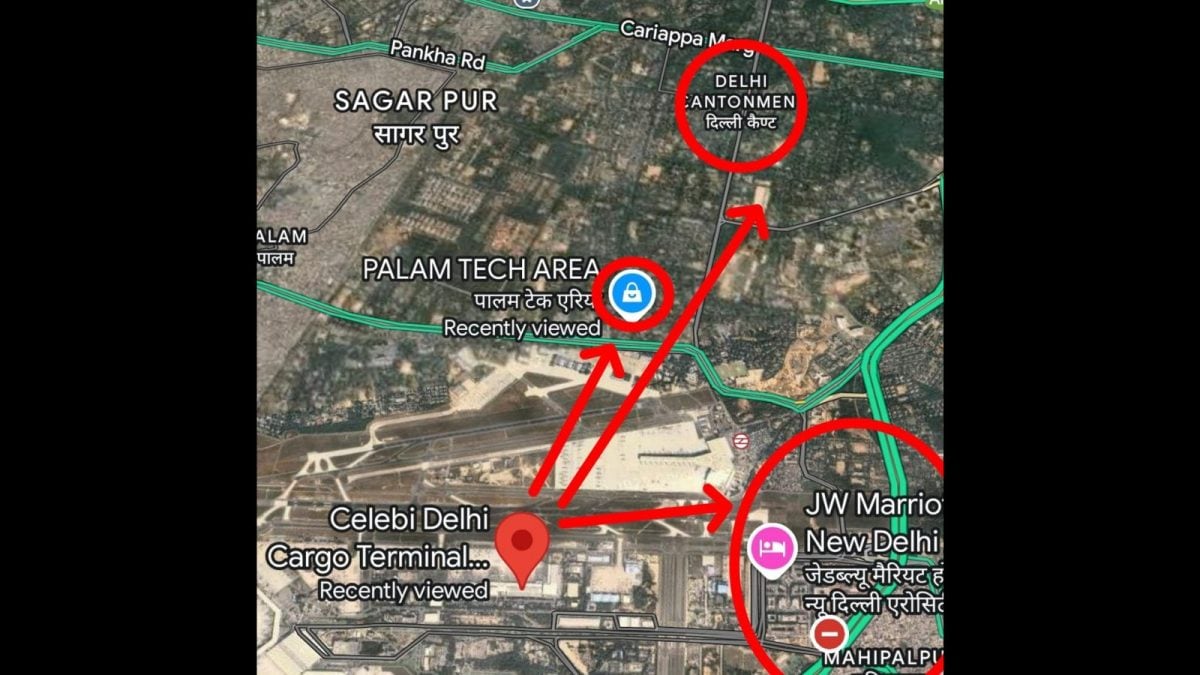

During their interrogation, Jadvani and Khokhar admitted to running an operation out of Raj Textile Tower in Saroli. For the past nine months, they had been persuading individuals to open bank accounts in their names. The account kits, along with SIM cards registered to these accounts, were then handed over to another accused, Divyesh Jitendrabhai Chakrani, who forwarded them to a contact in Delhi, identified as Vineet Prasad.

These materials were subsequently used by cyber fraud operators.

Majority of suspicious transactions routed through RBL Bank

Udhna police’s Special Investigation Team (SIT) discovered 165 suspicious accounts across various banks, 89 of which were with RBL Bank. These 89 accounts alone processed transactions worth ₹1,455 crore over a six-month period.

The scale and speed of these transactions raised suspicions of insider involvement, prompting the SIT to probe the role of bank personnel.

Senior bank officials allegedly accepted bribes

The investigation revealed that several employees of RBL Bank, including senior staff such as the area head Amitkumar Gupta, operations head, and other staffers, had allegedly accepted bribes to open accounts in the names of unrelated individuals. These accounts were then used to conduct high-value transactions linked to cyber fraud.

Police confirmed that the fraudulent activities were facilitated across the bank’s Vesu, Sahara Darwaja, and Varachha branches.

Eight employees taken into custody

Based on evidence gathered during the investigation, the SIT arrested eight employees of RBL Bank on Tuesday. These include senior officials and front-line staff suspected of directly enabling the fraud through unauthorised account openings and negligent oversight.

Case linked to larger cybercrime syndicate

Officials believe the racket may be part of a larger national or transnational cybercrime syndicate. Investigators are now working to trace the end-users of the fraudulent accounts and identify the final destinations of the laundered funds.

The case remains under active investigation, and authorities have indicated that more arrests may follow.

What's Your Reaction?